First, an excellent video of Ron Paul vs. Ben Bernanke. Ron Paul illustrates the difference between a silver ounce and fiat money in their respective purchasing powers of gasoline.

Some people may ask: but why should the purchasing power of money grow with time? If you're paid $100 today, why should they buy more stuff in one year from now than today?

First, remember that price of X in terms of Y is determined by abundance of X and Y and demand for them. If, at one point, you have equal amounts of apples and oranges in the society (and demand for them is equal), you should be able to exchange one apple for one orange. If, at another point, the supply of apples doubles (but demand for both products stays the same), you should be able to buy two apples for one orange.

This is why when the amount of money grows faster than the amount of products and services, you can buy less with your $100 as the time goes by.

Now the explanation why it should be the opposite:

The money's value should increase in order to match the increasing amount of products and services that whatever the money was given for produced.

For instance, if you pay you neighbor's daughter — let's say her name is Chaya — to babysit your kids, you free up some of your time to do something productive in the society. As the time passes, the time that Chaya allowed you to free up leads to an exponential increase in products and services available, as a result of your productive labor in those few hours. Therefore, her "share" in the society's products and services (which she can get by cashing in the money you paid her for babysitting) should grow. The longer she waits, the more it should grow.

It's not really different from any other kind of investment. Chaya invests her efforts into society, which leads to increase in products and services. As the time goes, the number of products and services in the society grows as a result of Chaya's efforts. Therefore, the expected reward for Chaya's investment in the society should also grow.

In reality, the opposite happens. The result of Chaya's input into society increases, but her reward decreases with time.

How can this happen?

It happens because the government steals Chaya's money. One way to steal someone's money is to take it from her directly (which the government does, in the form of taxes). Another way — in the case of fiat money — is to print up a lot of money to pay for your own expenses.

See, Chaya did something in order to get her money. She invested effort and time. But the government doesn't do anything. If it wants to pay for some additional governmental expenditures, it just prints up more money, reducing the value of Chaya's savings. As a result, Chaya can buy fewer products and services, while the government gets the difference for free.

Wednesday, February 29, 2012

Tuesday, February 28, 2012

Fad generators

In her novel Bellwether, Connie Willis (or, rather, her protagonist) is looking for a source of fads in the society. This article supports the suspicion of the author -- that the fads are started by teenage girls who use certain behaviors, such as vocal patterns, to fit in and create their mini-communities. Having started, the fads then spread into the rest of the society.

So, the next time you're annoyed by your teenage sister/daughter/neighbor/secretary saying "like totally", look at her with a new respect -- she is the driver of change in the American society. I wonder, however, if the fads started by teenage girls spread so easily through the communities where women and men do not communicate as much.

Now we need to figure out who started the fad of speaking like a redneck cargo ship captain that all "screaming neo-con" radio hosts have adopted.

Saturday, February 25, 2012

Simple argument against utilitarianism

The following is an excerpt from Stephen Kinsella's Against Intellectual Property. Obviously, it talks primarily about the utilitarian support for IP, but this argument can be used against any use of utilitarianism. (Emphasis is mine.)

Advocates of IP often justify it on utilitarian grounds. Utilitarians hold that the “end” of encouraging more innovation and creativity justifies the seemingly immoral “means” of restricting the freedom of individuals to use their physical property as they see fit. But there are three fundamental problems with justifying any right or law on strictly utilitarian grounds.

First, let us suppose that wealth or utility could be maximized by adopting certain legal rules; the “size of the pie” is increased. Even then, this does not show that these rules are justified. For example, one could argue that net utility is enhanced by redistributing half of the wealth of society’s richest one percent to its poorest ten percent. But even if stealing some of A’s property and giving it to B increases B’s welfare “more” than it diminishes A’s (if such a comparison could, somehow, be made), this does not establish that the theft of A’s property is justified. Wealth maximization is not the goal of law; rather, the goal is justice — giving each man his due.

Even if overall wealth is increased due to IP laws, it does not follow that this allegedly desirable result justifies the unethical violation of some individuals’ rights to use their own property as they see fit.Note that this is not the explanation why one may not own information he produced. For that, read Kinsella's monograph or my previous post (after the videos). I may write more about intellectual property and scarcity from Jewish point of view later.

Friday, February 24, 2012

The cost of legal fiction

Another comment from the anti-IP thread (for the first part, see this):

The law does not create rights; it recognizes them. When it recognizes the rights that do not exist, the particular law is not a real law, it is a legal fiction. Legal fictions lead to violation of other people’s rights when they are enforced.

For instance, "right" of a husband to relations with his wife is a legal fiction. It has been in place in most "civilized" countries until very recently. In the UK, until early 90s. In the US, until 70s, I think. Its enforcement led to marital rape.

[Incidentally, the Jewish Law strongly forbids spousal rape.]

The same can be said about any unjustified law. For instance, the supposed rights of a book's author to the information in the book contradict the rights of another person to his hard drive on which the electronic version of the book is stored.

Oftentimes, copyright is justified by the claim that "copyright piracy reduces the authors' sales". This argument is based on another pseudo-right, the right of the author to business transactions with his potential clients. What the copyright is saying is that the author owns other people's money even before they exchanged it for the copy of his book, which is clearly ludicrous.

Every application of law needs to be very strictly justified. The law comes in and tells a person what to do or not to do with his hard drive, with his house, with his car, with his body, etc. -- or else (it threatens with force and violence in the case of non-compliance to the law).

It better have a good justification for doing that. One justification I see protection of other people from violation of their rights. In case when this does NOT apply, the law is violating this person's rights needlessly.

That is why the whole approach of "every law is moral unless proven otherwise" is wrong. Every law is immoral unless proven absolutely necessary to protect other people's rights. That is why people who hold to my point of view (which includes the Founding Fathers and approximately one Congressman today) hold to the idea of a limited government.

This is all simply from the moral, rights-based perspective. In reality, as it is usually the cases with most unethical laws, copyright harms the society by stifling creativity and competition and increasing copyright-related lawsuits. History shows that in such areas as art or music, creativity flourished the most during the periods when works of intellect were not protected by monopolies.

Thursday, February 23, 2012

What does it mean to own information?

I am quoting below my post in a go thread lamenting the widespread "piracy" of go writers' books (most of which are not actually available in many bookstores). I already discussed the non-scarcity argument before (after the videos), but here I also address the arguments "if you pirate my work, my sales will drop" and "the law says this is copyrighted".

* * *

[I wrote the following statement in a previous post: "It is funny that book writers make money from writing about other people's so-called 'intellectual property' (the games they played, the move combinations they invented, etc.) and do not reimburse the players or their families, yet they complain about the 'piracy'. Hypocritical much?"

Someone answered that a particular game played between two people is not recognized by law as intellectual property, while a book discussing that game is. Here is my retort.]

What difference does it make whether some law protects something or not? You are merely saying that a large organization with a lot of guns recognized something arbitrarily as "property" and decided to give monopoly to it. Imagine that my friend is a Russian mafia mobster who "recognizes" all possible piano concerts by all pianists (and sales of tickets to them) in South Brooklyn as his property. He has a lot of guns too (admittedly, not as many as the Federal government). Therefore what?

Whether or not something is legal and whether or not something is moral have nothing to do with each other. There are plenty of cases from history when things were legal but not moral or illegal but moral. For example, American democratically elected state governments at some point recognized slaves as property, protected slavery by law, and recognized assisting slaves to escape as illegal. The first "patents" were actually permissions to rob foreign merchant ships that were granted by European governments at times of war.

Remember, every time you apply a law, you're applying force and violence. You're telling people what to do with their property (such as "you may not use your hard drive and the data on it in this particular way"). When you apply violence/force to someone, you better have a good reason for doing so. The only reason that I see is when you're defending your property or yourself from violence being applied to them. For instance, if I take your pencil, you can use force to take it back. Why? Because the pencil is scarce. Only one of us can use it. So, violence will be applied to one of us. So, let us choose the lesser of two evils and let the force NOT be applied to the one who has a better claim to the pencil.

But information is non-scarce. When I use your idea, that in no way prohibits your use of the same idea. So, scarcity cannot be used as justification.

Your sales will drop if I redistribute the contents of your book for free? Well, you don't own future potential sales. You don't own your potential customers, their money, and their potential custom. If I open a shop right next to yours, I am not "stealing" the customers from you, since you never owned them to begin with. When you're saying that information is property, you're saying that you own potential future business transactions. But that is clearly ridiculous, since it contradicts other people's ownership of themselves and their property.

In general, utilitarian arguments cannot be used as a basis for morality. Such arguments allow nine people to rip a tenth person apart and harvest his organs. [...]

Let me repeat my previous question: does the writer of Kamakura owe nothing to Go Seigen and Kitani Minoru for using their completely new and very specific ideas? Why is it that the specific way of arranging black-and-white letters on paper is "property", but a specific way of arranging black and white stones on a somewhat thicker piece of wood is not?

Wednesday, February 22, 2012

Why did Solyndra fail?

This is the response to the above question that I wrote on Quora. The answer is in no shape or form my own original thoughts, although I have thought about these concepts and tried to understand them. The answer is, however, in my own words. It is a little repetitive, but that's because I wanted to make sure I got the mechanism of boom–bust cycle from the Austrian point of view across.

(Also, the reason I keep going on about tulips is because I find the subject interesting.)

* * *

Because the interest rates go down, entrepreneurs are encouraged to invest in various long-term projects that suddenly look more profitable (since long-term borrowings are more sensitive to interest rates). The long-term projects usually include "capital-goods" industries, like steel or tractors, but can include any project with a long-term gain, like housing today or tulips in the 17th century Holland (why tulips?.. well, tulips take 7 years to appear from a seed).

This results in a malinvestment in these projects. Why malinvestment? Well, let me back-track.

Under free-market conditions, interest rate matches public's spending time preferences. So, if people want to spend not now, but in the future, they save. The increase in savings accounts leads to the banks holding more money, which they loan out more readily, lowering interest rates. The entrepreneurs, as I mentioned, then invest in long-term projects. Luckily, this matches the public's spending time preference! As the consumers decide to spend in the future, the long-term investments of the entrepreneurs lead to appearance of the future products, for which there is demand in the future.

(In addition, as the customers spend less at the restaurants and movie theaters, the resources, human and material, are freed up to be used by the long-term projects.)

But when the interest rates are lowered artificially by the Fed (or King of Spain whose gold ended up in the Bank of Amsterdam) and there is a lot of easy credit, the investments in the long-term projects are unmatched by the changes in spending preferences! The people never decided to save up now to spend more in the future. So, when the time comes for the long-term investments to reap reward, they don't.

This is why in any bust that follows a boom of malinvestment, there is usually a cluster of long-term project failures. In the 19th century, it was the railroad companies (that failed during every boom-bust cycle created by newly formed Central Banks). In the 21st century, it's housing and solar panels. In the 17th century, it was tulips. From macro-economics perspective, this cluster of failures looks like "recession" and "economy down" and "no growth", but if we realize that these businesses grew as a result of malinvestment, we will see that this recession phase is nothing but a healthy process of capital flowing from wrong targets of investment to the proper ones (as the businesses that have the consumers' custom buy up the equipment and hire the workers from the failing businesses).

In addition, if an investment fad was created (for example, the government pushing for easy housing or green projects, or a fad in tulips), this helps to create the malinvestment bubble — but what makes the bubble possible is the easy credit! (In fact, oftentimes, when the easy credit money runs out, the bubble bursts immediately, such as happened in the case of 17th-century Dutch tulipmania. Sometimes it takes years to realize that the increased supply -- for instance of houses or solar panels -- was unmatched by the demand from the populace.) This is an article by Mises in which he proves that without easy credit, no boom would be sustainable.

So, why did Solyndra fail? For the same reason the housing market failed. The government created (for political reason) new fads: housing and "green" energy. Federal Reserve (first Alan Greenspan, then Ben Bernanke) pumped the banks with the money that it created from the thin air (literally by adding zeroes to their accounts through open market operations after buying back government bonds at a price very profitable for the banks). This lowered interest rates, made the cheap credit of newly created money available for the entrepreneurs, for whom long-term investments in housing, steel... and green energy now looked profitable. But all of these investments were not matched by changing public spending time preferences (people in the early 2000s were not saving up money to spend in the late 2000s on houses and solar panels... at least not enough people to match the investments). Eventually, the bubble burst.

The banks that made bad investments in the housing market were bailed out. Solyndra and a bunch of other businesses went bankrupt.

The thing is: the fact that it failed was a good thing. It was investment of capital (from entrepreneurs and Obama) that was never matched by the customers' demand. That this capital was re-bought by the people (or was it?) who knew how to match the customers' demand is a good thing.

The fact that the banks (or car industry) were not allowed to fail, their assets being bought (and their personnel hired) by more responsible firms, was a bad thing.

Tuesday, February 21, 2012

Free market for medicine?

One of the comments to the post called "Halachic Basis for Medicare" said, in part (check the thread to see the rest of the comment and my answers to it), the following:

In fact, Health Care is a great example of an industry that likely confounds the free market.

Consider: For thousands of years, health care operated with free market principles. Yet, there was very little relationship between the amount of money spent on a treatment and its efficacy. This is because health care providers have something I like to call a "Confuse-opoly".

The product they are selling requires a lot of specialized knowledge to detect quality. As a result, customers have a very hard time making rational market decisions. The best treatments fail to work many times, and patients often recover without any medical care, so it is super-hard to separate out the value of the care being offered.I would like to ask the author of the comment to provide evidence for what he is talking about, but I assume he is talking about practices like bloodletting.

Back in the day, when a person felt sick, he went to a doctor. The doctor looked into the current medicine books (which were based on pseudo-scientific Aristotelean view of the world) and opened up the patient’s veins to let some blood out. Obviously, this did not help the patient, but he still paid for the service, because the doctor said it was the best treatment.

If a patient was richer, he might have ordered more blood-letting services, like leeches. Or maybe some smelling salts. Or, if he was in China, he might have ordered accupuncture or tiger-bones soup, which were also not helpful.

So, why were these patients paying for bad treatment? Why didn't the free markets improve the quality in this service?

First, I urge everyone to read this article: "Socialized Healthcare vs. the Laws of Economics".

And these are my answers to the above argument:

1. I assume my friend would be able to tell a difference between healthcare in Russia (back in the day or now) vs. China vs. county hospital in the US vs. a private clinic. I assume the same about most people. And it's not just about the fact that some hospitals have Au Bon Pain in their lobbies.

2. Yes, some treatments hoodwink people into paying for them and thinking that they got better as a result of the treatment. But some treatments do make them feel better because they treated the symptoms. So, just because people sometimes get confused about the quality of the service they are receiving, doesn’t mean that they are always confused. I.e., if the population selects (with their money) the services that they think make them feel better, sometimes they will have false positives (and false negatives), but on average, they will select for improvement of the services.

3. My friend's argument is making a value judgement. It’s similar to saying: "Some people buy cars that have velvet seats and nice A/C and eye-pleasing color. Fools! A good car is a good engine, brakes, transmission, etc. How is the free market controlling for car quality?" Well, who says velvet seats and nice A/C are not products?

Perhaps the doctors who did leeching and accupuncture provided the patients with a sort of psychotherapy or a comfort therapy. They did not cure the disease (because they didn’t know how), but they provided them with a peace of mind (not to mention the possible placebo effect). It is not different from someone today doing pain management as opposed to curing the actual cause of the disease.

4. Yes, the doctors were only able to provide mumbo-jumbo treatment when there was none better available. But as soon as science and technology improved and the better results of the new treatments were clear, the patients were not so stupid as to stick to bloodletting and ignore vaccination, penicillin, and surgery. In the late-19th-century England, the free markets drove out the country doctors who practiced medicine the "good old way", because younger Sorbonne-educated doctors produced visibly better results. Plus, they explained their treatments, and many people (first of higher and middle classes, then even the rest) were educated enough to know the difference.

Going back to the car example, there are people who like "red cars" that have nice leather seats and good stereo system, and there are people who like Italian sport cars that are stripped of everything except the basic parts and have a really powerful engine.

Which brings me to my next point:

5. The markets are only as good and as efficient as the people who fill the markets. The product that the markets select for depend on the people's preferences. If people have bad taste in movies, you will get American movie industry. (Here, I know, I am making a value judgement.) So, if people are uneducated, they might select for the mumbo-jumbo comfort treatments.

We know, however, that with time, people's education improves and certain scientific facts and ideas enter the population's mind (partly because there are people who profit from spreading knowledge, either directly or indirectly). This should improve the effectiveness of judging the quality of medical service.

The assumption that people are going to stay on the same level of medical knowledge does not seem founded for me. That certainly has not happened over the course of the 20th century. (Most people know today about risks of strokes, the importance of exercise, and if someone got cancer at the age of 80, it's probably not because of the cell phones, but because of the old age. There are mythbuster TV shows and books everywhere that tell people that obsessively washing hands with antibacterial soap is bad and that we use more than 10% of out brain.)

6. It's very easy to point out the problems with something. But when one does so, one should point to a better alternative. Otherwise, all one is saying is that life is not perfect.

What’s the alternative? Ivory-tower sages deciding what is "really" the best treatment and what is "really" the best hospital? But it’s these ivory-tower sages that have historically told their patients that bloodletting was the way to go. Nowadays, ivory-tower medical giants recommend getting epidurals while giving birth, even though that increases the health risks for the mother and oftentimes makes the necessity of a C-section more probable, which presents the risks to the fetus and decreases the future fertility of the mother. (My wife who has little background in Biology found this out by reading various medical sources by herself.)

Also, how do we control for the quality of the ivory-tower sages (the Surgeon General and the likes of him)? These people are appointed by bureaucrats and politicians who, like everyone else, can have trouble distinguishing between good treatment and the bad. (I mean, they definitely have a hard time distinguishing between good science and the bad in the area of climatology.) And how do we know that the politicians are doing a good job? Who controls them?

I guess it comes down again to the people. So, if the politicians appoint bad Ministers of Healthcare who make bad decisions about the medicine, people can always vote the politicians out, right? Basically, that's the system in Russia today. Except, of course, this doesn't work, since many people are not single-issue voters ("de gospitals are vorse, but Putin brot stability to de kantry"), because the alternative may be worse, and so on.

Also, how are the people to decide whether the politicians are doing a good job? They can look at the statistics, but they can also at the individual hospitals' statistics.

The bottom line is: people can control the quality of healthcare through a complicated system of bureaucracy and politics which is extremely inefficient (it's like trying to ride a bicycle while standing on ten-meter-high crutches), or they can "vote" for the efficiency of the hospitals and doctors directly, with their money.

Monday, February 20, 2012

Thomas Jefferson of our generation

I don't know who will be nominated when. I don't know who will win what. But I personally am happy that so many of the young people stand with liberty (of course, the graph below shows that so many people still stand with tyranny). Watch until the end for a surprise announcement.

A screenshot from Votizen.com:

Sunday, February 19, 2012

US vs. UK

Someone made a claim in a Youtube discussion that UK economy was the greatest success story for free markets in the 19th century.

In Europe that may be true, but worldwide, the US had fewer regulations than the UK and experienced a faster growth of economy in the 19th century.

Using Measuring Worth web-site, one can see this: the slope of the US graph (in blue) of logarithm of real GDP is steeper. Click on the image to enlarge.

In Europe that may be true, but worldwide, the US had fewer regulations than the UK and experienced a faster growth of economy in the 19th century.

Using Measuring Worth web-site, one can see this: the slope of the US graph (in blue) of logarithm of real GDP is steeper. Click on the image to enlarge.

Friday, February 17, 2012

Whoops

"So, what does this lever do?.."

(source)

All jokes aside, Alexander Petrosian is an awesome photographer. On his pictures, Russia comes alive: good, bad, and everything else.

(source)

All jokes aside, Alexander Petrosian is an awesome photographer. On his pictures, Russia comes alive: good, bad, and everything else.

Thursday, February 16, 2012

Two memories

As I was looking through the pictures of the photographer Alexander Petrosian from Petersburg, the following two stood out. They very nicely reminded me of the two sides of my childhood in Ukraine. Not just the content of the pictures, but also their emotional atmosphere.

Unfortunately, I think for me (and other people living there, up to now), there was much more of the first than of the second.

If you ask me what my image of Russia (or the whole former Soviet Union) is today, it's basically this:

(As one of the comments to the picture said: "We are born to make Kafka's works reality.")

Unfortunately, I think for me (and other people living there, up to now), there was much more of the first than of the second.

If you ask me what my image of Russia (or the whole former Soviet Union) is today, it's basically this:

(As one of the comments to the picture said: "We are born to make Kafka's works reality.")

Wednesday, February 15, 2012

Halachic basis for Medicare?

(George Washington, asking G-d whether he should socialize horse fodder production)

The Jewish Law blog, to which I am subscribed, linked to the following article in its recent post. You can read the article yourself, but basically, it argues that Halacha supports or even mandates some sort of socialized healthcare provided by the government through taxpayers' money. I urge you to read the article.

These are my two responses to it. The first one is rather brief and does not address my view of Dina D'Malchusa Dina fully, for I did not (nor do now) have time and all the necessary sources at my disposal for a full answer. This is my limited answer then:

First part:

A few comments:

1. Of all the leaps of logic found in this article, this is probably the greatest in my opinion:

“Applying this ruling leads to the conclusion that once a person is part of a community, there is a broad scope of public services that a community can compel its citizens to pay for. However, it would seem that the communal funds must be gathered for the purpose of meeting a public need.

It would be easy to imagine that public medical insurance could meet this definition. Medical care is a service that everybody needs at one point or another and if a town decides to create a communal insurance system to address the issue, the town would presumably have the right to set up such a system.”

I can include almost every aspect of everyday life under the logic of the last sentence and then (following the logic of the quoted passage) include it under “a need of the community” that needs to be provided for by the government through compelled taxation.

For instance, cell phone service. Everybody in modern society, at one point or another, needs to make a call.

Food. Shoes. Clothes. Computers. Cars. Chairs. Housing. Etc.

This logic leads straight to socialism — all the property of the populace is transferred to a secular (or religious) “beis din” and then redistributed back according to the political or social calculations of the beis din.

Meanwhile, socialization of medicine leads to real decrease in the quality of services provided. Israel is a good example of how a potentially good medical system can be ruined by socialization.

2. The author of the article does not define a “thieving government”. My perusal of various Halachic sources suggests that the US government may very likely fall under this category.

3. Is there a source extending the rights of a Jewish king to eminent domain to a secular king (a king who is not a Jew or a Noahide gentile)? The article does not provide one.

4. I found this footnote curious: “19 Ad loc sv mahu; also see Rashi sv vayatzilah holding that it is forbidden to save oneself with the money of one’s friend” (p. 102 in the text).

The system of society that the Americans have established in the Thirteen Colonies during and after the American Revolution is not that of monarchy. This is not a trivial point. According to the philosophy of the Founding Fathers (explicit in the Declaration of the Independence, Federalist Papers, the Constitution, etc.), American government does not own the people. The people are not its subjects, and the government is not a sovereign.

The people are the government’s clients. The people are considered to possess certain natural rights to their property and livelihood, and they hire the government to protect those rights. They delegate their rights to the government. Thus, for instance, if I have a right to defend myself, I can delegate that right to the government.

That is the relationship between the people and the government. Now, if you follow Rashi’s stated opinion, if I may not compel you to save my life with your property (or use your property by force to save my life), I should not be able to use a company that I hired as my representative to do the same.

Second part:

This is all ignoring the question of even if it permissible for the current governments to tax people for whatever transfer-of-property scheme, whether it is a good idea for us to allow it. I.e., just because something is halachically permissible, does not mean it is a good idea pragmatically. (One could even say that it does not necessarily mean it is moral.) One can find halachic sources allowing beating one's wife if she did not cook the dinner...

One point is the one I already raised in the [previous] post: allowing the government to manage any kind of industry (from shoe making to television to roads to medical care) basically ruins that industry. The best way that the decisions about direction of capital in an industry can happen is through free market — competition and cooperation between service-providers for the customers' business (and competition between the customers for the products and services in the cases when the latter are scarce).

The government (or any other monopoly) does not have the necessary foresight to manage the resources most effectively. This argument is known as “economic calculation problem” and was presented by Jewish-Austrian libertarian economist Ludwig von Mises.

The other problem with government-provided medical care is that it violates people’s “natural rights” through taxation (the taxation is potentially justified from natural rights perspective only when the one taxed receives some products or services in return). Now, a frum Jew may not be worried about “natural rights” as presented by the Western philosophers of the 18th-19th centuries, but, unfortunately, the history has shown that once you allow the government to violate natural rights for the supposed “common good”, you open the door for it to violate many different kinds of rights and interfere in personal lives — including Jews’ religious personal lives (not to mention their livelihoods).

All the regimes that constricted Jews’ freedom of religion have done so under the premises of “common good”. Indeed, if you follow their logic, they were doing Jews a favor by forcibly converting them to Christianity, not allowing their children to learn Torah, forcing them to send kids to secular governmental schools, etc. In our times, there has been a proposal to ban bris in San Francisco. It was rejected — but in many European countries, shechita and bris are banned. Homeschooling is banned. (So, if there are no private Jewish schools available in one’s area, one has to send kids to a public school or have them taken away by the state. Chabad shluchim in Sweden are currently facing this problem.) The list, from the past, the present and the potential future goes on.

Even in Israel, frum Jews are forced to listen to kol isha in the army, because a posek in the army has declared that it’s muttar. Well, these Jews’ poskim disagree, but the opinion of this, more meikel, posek is imposed upon them by the state. We see that Jewish governments and frum elements within them can be just as tyrannical.

Therefore, it seems to me that even if the government may have a number of powers granted to it by Halacha (a statement that I personally do not necessarily agree with), it may still be a bad idea for us to support a government that exercises these rights. Until Moshiach comes, the government that governs least governs best.

Monday, February 13, 2012

If you love the animals, you eat them

Or at least make them commercially useful. This way, not only do you ensure their survival as a species, but you also ensure their survival in the wild — since you create a competition to the poachers.

Saturday, February 11, 2012

19th century vs. 20th century

Someone, in a conversation with me, has claimed that if we went back to the gold standard, or at least, if the Central Bank did not inflate the currency, there would be zero economic growth (or even a recession).

I countered that we certainly did not observe this happening in the 19th century, when US and UK economies grew very rapidly.

He answered: Yes, they grew, but not nearly as rapidly as in the 20th century.

Let's see if he is right. One thing about the growth of the economy is that it is an auto-catalytic process: the product catalyzes the reaction, so the more product you have, the faster the reaction rate. If you start off with $100, your business will grow slower than if you start off with $100,000. (Your business will grow as a result of you re-investing a portion of your profit. The more you invest, the more it will grow. But since your profit from $100,000 will be greater than from $100, your business growth rates will be different.)

To correct for this, it's useful to look at the logarithm of growth, as opposed to pure growth. For those who don't know much math, logarithm is a function inverse of exponential function. So, if a graph shows exponential growth (as in the case of growth rate of an auto-catalytic reaction), its log will show a straight line.

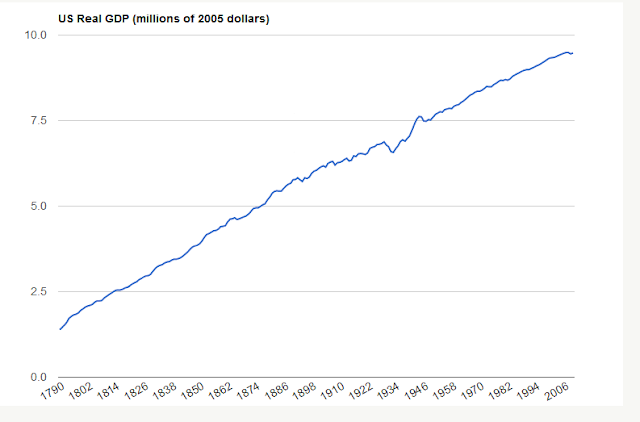

After this introduction, let's look at the data. The following figures show growth of GDP in the United States, from 1790 to 2010. The graphs are logs (including the second one, despite the label). "Real GDP" is adjusted for inflation, as I understand (I may be wrong).

I don't know about you, but to me, growth rates seem very comparable. And GDP is just the first measure of growth that came to my mind and not necessarily the "purest" measure of the growth of "real wealth".

(Source: Measuring Worth > Datasets > US GDP)

This is also a rather interesting graph — Consumer Price Index, in logs:

Here are raw data:

If you go to the interactive graph, you will see that the prices rose rapidly when US entered a war (the US Revolution in 1776, the War of 1812, the War of Northern Aggres... I mean, the Civil War in 1861, and the First World War in 1916). Then, FDR took away Americans' gold, and the prices rose for the duration of the Great Depression and the Second World War. Then, in 1967, the last tie to gold standard was cut, and the prices were rising ever since.

So, basically, the effect of US government on the prices of products and services is similar to that of a war.

Yeah, but if there was no inflation, there would be no growth, right? Go back to the beginning of the thread.

Some more background:

First, this: http://www.tomwoods.com/inflation/

Second, this:

I countered that we certainly did not observe this happening in the 19th century, when US and UK economies grew very rapidly.

He answered: Yes, they grew, but not nearly as rapidly as in the 20th century.

Let's see if he is right. One thing about the growth of the economy is that it is an auto-catalytic process: the product catalyzes the reaction, so the more product you have, the faster the reaction rate. If you start off with $100, your business will grow slower than if you start off with $100,000. (Your business will grow as a result of you re-investing a portion of your profit. The more you invest, the more it will grow. But since your profit from $100,000 will be greater than from $100, your business growth rates will be different.)

To correct for this, it's useful to look at the logarithm of growth, as opposed to pure growth. For those who don't know much math, logarithm is a function inverse of exponential function. So, if a graph shows exponential growth (as in the case of growth rate of an auto-catalytic reaction), its log will show a straight line.

After this introduction, let's look at the data. The following figures show growth of GDP in the United States, from 1790 to 2010. The graphs are logs (including the second one, despite the label). "Real GDP" is adjusted for inflation, as I understand (I may be wrong).

I don't know about you, but to me, growth rates seem very comparable. And GDP is just the first measure of growth that came to my mind and not necessarily the "purest" measure of the growth of "real wealth".

(Source: Measuring Worth > Datasets > US GDP)

This is also a rather interesting graph — Consumer Price Index, in logs:

Here are raw data:

If you go to the interactive graph, you will see that the prices rose rapidly when US entered a war (the US Revolution in 1776, the War of 1812, the War of Northern Aggres... I mean, the Civil War in 1861, and the First World War in 1916). Then, FDR took away Americans' gold, and the prices rose for the duration of the Great Depression and the Second World War. Then, in 1967, the last tie to gold standard was cut, and the prices were rising ever since.

So, basically, the effect of US government on the prices of products and services is similar to that of a war.

Yeah, but if there was no inflation, there would be no growth, right? Go back to the beginning of the thread.

Some more background:

First, this: http://www.tomwoods.com/inflation/

Second, this:

Friday, February 3, 2012

Effect of income tax on technological progress

[A re-post with some new points]

Oftentimes people tell me that science would not flourish as it has in the 20th century had it not been sponsored by income tax. The idea of private sponsorship of science (either in a form of investments, like in any other business, or in a form of donations) would not work, or at least would not work on the same scale as it has under governmental sponsorship. Until recently, I thought so too.

Let’s see if this is true — what effect has income tax (introduced in the late 19th century and made permanent in early 20th century) and, in general, government’s funding of science had on the rate of technological breakthroughs?

I think the effect is pretty clear. Until the end of 19th century, technology has been developing at an extremely high rate. Then, in late 19th – early 20th century, the rate started to slow down and then started to decrease. Saying “look how far we got in 20th century in terms of technology after government started sponsoring its development” is the same as saying “look how far I got walking on my feet after I abandoned my car on the side of the road”.

Recently someone told me that without inflation, there is no growth (apparently, Rick Santorum believes the same). I answered that England and US have grown tremendously in the period of 1700–1900 (when the currency was not only not inflating, but was actually deflating). He said: "yes, but it was the fraction of growth US has experienced in the last thirty years". I challenged him to provide me with evidence that the rate of growth was higher in the 20th century than in the 19th. Meanwhile, Tom Woods claims the opposite:

Going back to the question of governmental funding of science — so, why would private businesses fund science (after all, aren’t they interested in immediate profit?), and why don’t they do so now? Also, even if the businesses did fund science (and of course, they still do), it would be only applied, not fundamental science, right?

This claim is repeated by most scientists I know. No wonder most of them love the government.

Well, think about this: oil companies invest money in geological research that will produce real profit 30 years from now. Sounds to me like investment into fundamental science that gives long-term profit. (I certainly hope that my personal discoveries will provide humanity, iyH, with some practical benefit, in addition to added theoretical knowledge, less than 30 years from now.)

Now, imagine if the government used taxpayers’ money to do the aforementioned geological research? Why would the oil companies spend money to do it then?

Meanwhile, the cost of doing science has risen greatly, because the companies that supply universities with materials know they can raise the prices, since the government will pick up the bill. The same is happening in medicine and education.

At the same time, the quality of service is going down. It is very hard to buy a good antibody nowadays (as opposed to, say, 10 years ago), since the market is full of antibodies that do not work or don’t work well. The companies mass-produce them and sell them, knowing that the government-sponsored labs will buy them no matter what, since they are less careful with their money spending (after all, the government will pick up the bill, and if you run out of one grant, there is always another to be applied for).

And this is just one example...

Oftentimes people tell me that science would not flourish as it has in the 20th century had it not been sponsored by income tax. The idea of private sponsorship of science (either in a form of investments, like in any other business, or in a form of donations) would not work, or at least would not work on the same scale as it has under governmental sponsorship. Until recently, I thought so too.

Let’s see if this is true — what effect has income tax (introduced in the late 19th century and made permanent in early 20th century) and, in general, government’s funding of science had on the rate of technological breakthroughs?

I think the effect is pretty clear. Until the end of 19th century, technology has been developing at an extremely high rate. Then, in late 19th – early 20th century, the rate started to slow down and then started to decrease. Saying “look how far we got in 20th century in terms of technology after government started sponsoring its development” is the same as saying “look how far I got walking on my feet after I abandoned my car on the side of the road”.

Recently someone told me that without inflation, there is no growth (apparently, Rick Santorum believes the same). I answered that England and US have grown tremendously in the period of 1700–1900 (when the currency was not only not inflating, but was actually deflating). He said: "yes, but it was the fraction of growth US has experienced in the last thirty years". I challenged him to provide me with evidence that the rate of growth was higher in the 20th century than in the 19th. Meanwhile, Tom Woods claims the opposite:

Going back to the question of governmental funding of science — so, why would private businesses fund science (after all, aren’t they interested in immediate profit?), and why don’t they do so now? Also, even if the businesses did fund science (and of course, they still do), it would be only applied, not fundamental science, right?

This claim is repeated by most scientists I know. No wonder most of them love the government.

Well, think about this: oil companies invest money in geological research that will produce real profit 30 years from now. Sounds to me like investment into fundamental science that gives long-term profit. (I certainly hope that my personal discoveries will provide humanity, iyH, with some practical benefit, in addition to added theoretical knowledge, less than 30 years from now.)

Now, imagine if the government used taxpayers’ money to do the aforementioned geological research? Why would the oil companies spend money to do it then?

Meanwhile, the cost of doing science has risen greatly, because the companies that supply universities with materials know they can raise the prices, since the government will pick up the bill. The same is happening in medicine and education.

At the same time, the quality of service is going down. It is very hard to buy a good antibody nowadays (as opposed to, say, 10 years ago), since the market is full of antibodies that do not work or don’t work well. The companies mass-produce them and sell them, knowing that the government-sponsored labs will buy them no matter what, since they are less careful with their money spending (after all, the government will pick up the bill, and if you run out of one grant, there is always another to be applied for).

And this is just one example...

Double-convex yunzi stones

Anniversary (ke"h) present from my wife:

Ordered on Amazon here (originally from Yellow Mountain Imports). The bowls and the bag look just like advertised:

If you're looking for something alternative to glass and cannot afford shell and slate, I recommend these stones very strongly. They are very beautiful and feel very nice when held or placed on the board. If you wash and oil them (make sure to use only mineral oil; definitely no food oils!.. afterwards, wipe the excess oil off), they will feel very smooth. And they have a nice feeling of heaviness and shapiness.

Black stones have deep, rich, chocolaty color to them. White stones have a beautiful light-greenish glow (hard to capture in the pictures) when sitting together in a bowl.

Ordered on Amazon here (originally from Yellow Mountain Imports). The bowls and the bag look just like advertised:

If you're looking for something alternative to glass and cannot afford shell and slate, I recommend these stones very strongly. They are very beautiful and feel very nice when held or placed on the board. If you wash and oil them (make sure to use only mineral oil; definitely no food oils!.. afterwards, wipe the excess oil off), they will feel very smooth. And they have a nice feeling of heaviness and shapiness.

Black stones have deep, rich, chocolaty color to them. White stones have a beautiful light-greenish glow (hard to capture in the pictures) when sitting together in a bowl.

Thursday, February 2, 2012

Honinbo Shusaku dissected

I think this is an amazing video analyzing one of Honibo Shusaku's games. I don't speak Japanese, but because of the computerized visual aids used in the video, I understood everything that was said. I highly recommend it for the people to understand both the flow of a go game and Shusaku's style.

The content is for beginners in go.

Shusaku is playing Black.

The content is for beginners in go.

Shusaku is playing Black.

Economic cycles before FED

If students of Austrian economics school (such as Ron Paul) claim that economic cycles are caused by FED's machinations with money supply (i.e., inflation) and artificial manipulation of interest rate, what about the depressions before FED's existence? How do you explain those?

Please watch this video with one of my favorite speakers, Tom Woods:

Many people in discussions of pre-FED booms and busts will point to one of the most famous cases of those: tulipmania in Holland —

Please watch this video with one of my favorite speakers, Tom Woods:

Many people in discussions of pre-FED booms and busts will point to one of the most famous cases of those: tulipmania in Holland —

A period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then suddenly collapsed. At the peak of tulip mania, in February 1637, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftsman. It is generally considered the first recorded speculative bubble (or economic bubble), although some researchers have noted that the Kipper- und Wipperzeit episode in 1619–22, a Europe-wide chain of debasement of the metal content of coins to fund warfare, featured mania-like similarities to a bubble. The term "tulip mania" is now often used metaphorically to refer to any large economic bubble (when asset prices deviate fromintrinsic values).Please read an amazing article by Doug French: "The Truth About Tulipmania".

Subscribe to:

Posts (Atom)